Customer Services

Copyright © 2025 Desertcart Holdings Limited

Full description not available

J**R

Possibly the best book I've ever read!

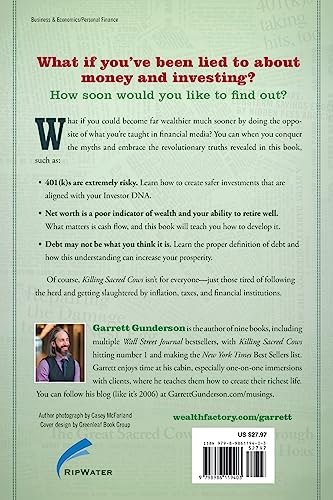

I'm reading a book right now called "Killing Sacred Cows - Overcoming The Financial Myths That Are Destroying Your Prosperity" and immediately upon finishing the Introduction to this book, I could tell that it was worth every cent I paid for it and more. In this book, Garrett B. Gunderson breaks down many financial myths that are spread throughout our society and furthered by our schools, financial advisors, and our families and friends that cause us to believe that thinking outside the myths is "too good to be true" or at worse "risky." Gunderson lays out 9 common financial myths and destroys all of them. The crazy thing is, these are pretty common sense, but you would likely never think of them yourself. That is why we all need to read this book.During my reading I thought, "EVERYONE needs to know this stuff!" So I decided to highlight a few notes from the book and portions I highlighted to share with everyone, but these are only SOME highlights I made. Before going any further, place your trust in me and order this book. It is absolutely incredible and game-changing. I have taken the steps to make it easier for you and included a link directly to it right below. I cannot say enough about how amazing it really is.:Killing Sacred Cows: Overcoming the Financial Myths That Are Destroying Your ProsperityThe Introduction: Gunderson states that the dictionary defines a "sacred cow" as an individual, organization, institution, teaching, or belief often considered exempt from criticism or questioning. He then relates it to the financial world claiming that its sacred cows "are the myths and traditions that distort our thinking about money, wealth, success, and prosperity."Throughout the introduction he poses many thought provoking questions including this one, "If only a minority of people are wealthy, why do we follow what the majority of people do financially?" When I read that, all I could think was "WOW! That's a great question." You always hear the majority of people putting their money in 401(k)s, putting it in a CD, some high yield savings account, etc. None of the people I know that do that are wealthy or seem to be on the track to becoming so. In fact, the people I know that are wealthy don't do any of that. This question began to create a mind-shift for me.This book, and particularly this section of it, is riddled with spectacular quotes. He helps the reader to see what true prosperity is and the cost of following a myth rather than our passion. He quotes John F. Kennedy saying, "There are risks and costs to a program of action. But they are far less than the long-range risks and costs of comfortable inaction." My favorite quote by far in this section is from Steve Farber, "Do what you love in the service of people who love what you do."Gunderson challenges us to find our Soul Purpose, which is our way of adding value to the world and states that "if our new goal is to create value in the world, not simply build our net worth, then how we go about becoming prosperous changes forever.""Try not to become a man of success, but rather try to become a man of value." - Albert EinsteinNear the end of the Introduction to this book, Gunderson lays out some of the things you will learn by reading it including:How the scarcity paradigm, which is at the root of so much common financial advice, limits our financial successHow the "accumulation theory" of wealth that most of us subscribe to destroys our potentialWhy "investing" in the stock market for most people is little better than buying lottery tickets - and how you can create real wealth insteadHow most people are in a security dilemma caused by avoiding things they fear, which actually decreases their security - and how to find true security yourselfWhy money doesn't equal powerWhy the most lucrative investments are by nature the lowest riskWhy the best way to reduce the cost of insurance is to buy the most you possibly canHow false beliefs about "getting out of debt" may keep you from financial freedomWhy value is infinitely more important than price.His underlying questions for all of us, as he asks in the beginning of his Introduction, are "What if everything you thought to be true about money and finances was actually completely false? How soon would you want to find out, and what would you do about it?"My goal is to lay out my notations on each of the 9 myths not only to help educate people that may have the same or a worse mindset than me, but also to journal so that I can learn through repetition. This is truly one of the most incredible and thought provoking books I've ever read. Do yourself a great service and purchase it today and read it as soon as possible. It'll change the way you think of money, your worth, and how you live your life.

W**R

Quiet the Naysayers

When this book first came out, I did not buy it because of the negative reviews and the sarcasm they contain. For the last couple of years, I have been blogging about some of the concepts that Gunderson addresses early in his book on my own personal finance blog. I also follow several personal finance blogs that focus on frugality. Frugality at the expense of living. One personal finance blogger tested some recipes from NPR designed to provide frugal meals for a family of four. The recipe he tested fed his family for about $1.40 per serving. He decided he could do "better", taking out the natural and whole food ingredients and replacing them with processed ingredients, he lowered the cost to 60 cents per serving! This same blogger has written that he and his family don't worry about money! The scenario that I just described is exactly what this book is about: That current financial planning strategies support a scarcity mindset that robs one of the ability to live in the here and now. This is not a book about how to be a spendthrift, this is a book about taking personal responsibility for one's financial future by considering strategies that allow greater fulfillment in the here and now. Current financial planning does not do that. Despite the fact that there is growing evidence to the contrary, current financial planning strategies say buy this product and adopt this asset allocation and you will be okay in 30 years. I have a friend who is a millionaire but is afraid to buy a plasma TV, although he would enjoy it, because it would deplete his financial reserves. So he spends his valuable time going to electronics stores, talking with sales people, waiting for each year's new models, although in his heart of hearts he knows he will never buy. About 6 months ago I replaced my old refrigerator. I had gone about as far as I could with repairs yet agonized over consumer reviews and sales until I finally made my purchase. While I was doing my "due diligence" I continually had to dispose of food going bad in my fridge. These sad illustrations are exactly the mindset fostered by our current approach to financial planning. Mr. Gunderson offers several illustrations of "broke millionaires", people with the net worth but not the cashflow to live. Gunderson simply says that our current emphasis on having a number in the bank rather than living is problematic at best. This book is not for everyone. If the current financial meltdown has you looking at your portfolio and thinking, "I smell a rat" then this book is for you. If the current financial meltdown has you thinking, "No worries, I'm in it for the long haul" even if that long haul is 30 + years, this book isn't for you.

M**S

Really good book

Solid advice. You may not want to agree with everything, but you should at least think about it and do some follow up investigating. This is a real eye opener and a great book. Highly recommended.

A**R

A different point of view

Garrett's book offers a new way of looking at your finances. You don't need to be tied down by the old ways of thinking.

W**N

Very interesting and informative book

Very interesting and informative book. Would recommend to others

M**M

Loosens your grip and opens your mind to new paradigms

This book has a new refreshing way to consider your financial future! Although I may not agree with some of the elements in the book, the book shows you a path in which to move away from the old and tired views of financial freedom. Society is so caught in a rut with how they create wealth that they're blind to the other opportunities. As a financial professional and strategic advisor myself having an open mind to new possibilities and new perspectives is the foundation in which this nation was built upon. Innovation - yes innovation in your financial future and that's what Garrett brings in this book. Whether you agree fully with what he says, it opens your mind up to a new way of thinking and when there is a new way of thinking there are new possibilities.It is time that we challenge the status quo and the institutions that have built it. Garrett's perspective allows you to do this in a new way. I think this is a most valuable resource for anyone looking for a way to build their financial future. With this information they can at least come to the conversation of financial freedom fully informed and able to look at it from different perspectives.

O**R

Taking Charge Financially

This book will give you very valuable ways to improve your wealth situation. It's like a spiritual perspective of how we view money and how it affects us. A must read to gain knowledge of what is truly important. I've been riveted and very happy I purchased this book.

K**N

Just getting ibti

Great book so far.

R**E

Just starting this book and already I can tell this ...

Just starting this book and already I can tell this is a game changer. Looking forward to diving in deep.

K**Y

Highly recommended!!

well written! Gave me a different outlook about money. Highly recommended!!

C**E

Five Stars

Real good book

Trustpilot

1 month ago

2 months ago