Customer Services

Copyright © 2025 Desertcart Holdings Limited

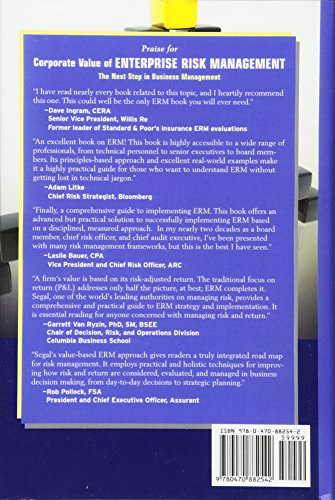

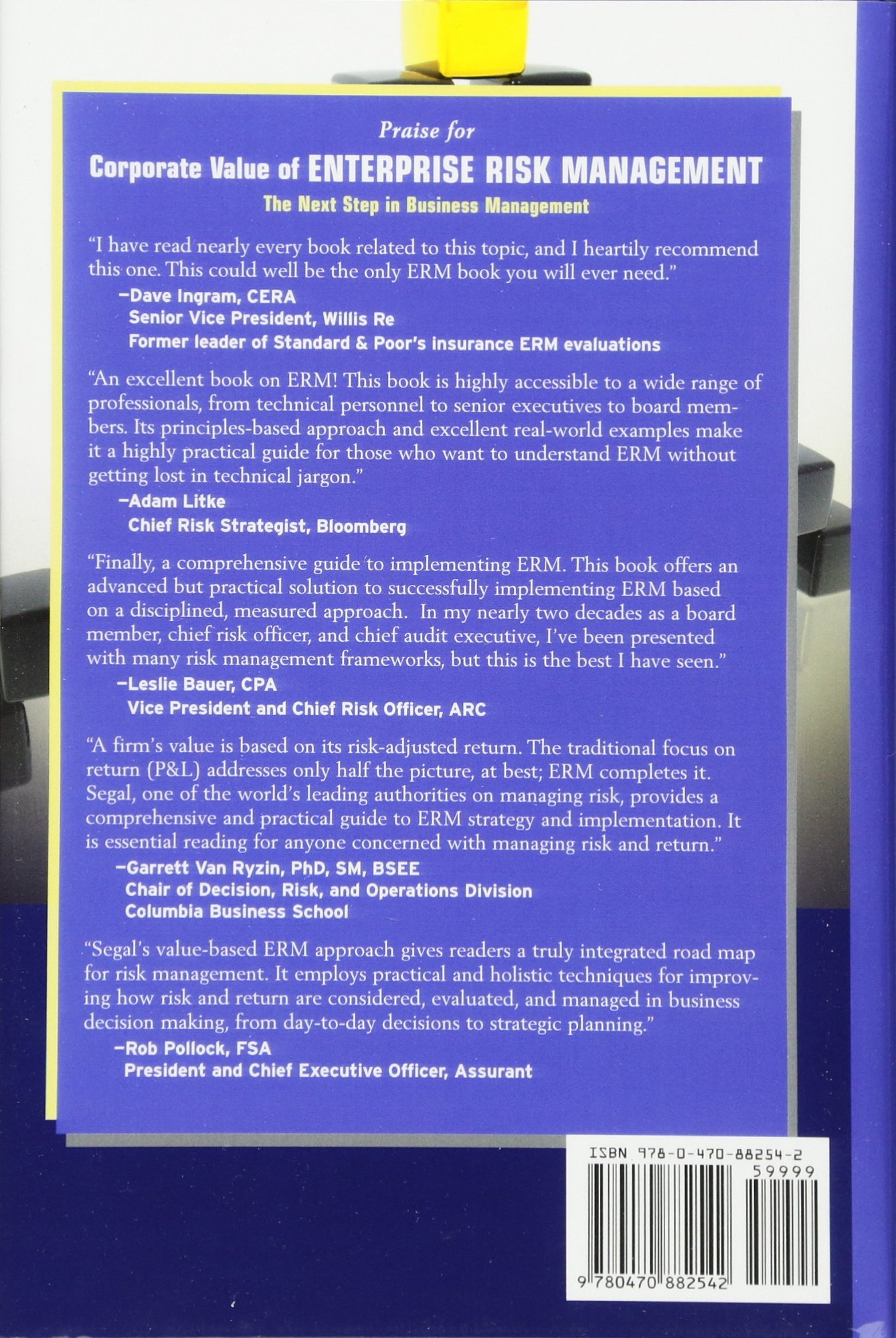

Corporate Value of Enterprise Risk Management: The Next Step in Business Management : Segal, Sim: desertcart.ae: Books Review: good Review: ERM practitioners have been striving for quite some time to build programs that measure risk in a quantitative manner, and that compares that risk back to management's appetite for risk taking. Sim Segal's book provides a practical methodology for a value based ERM program. Sim Segal does an excellent job in the opening chapters laying out the argument for value-based ERM in any enterprise, not just financial services firms. He also discusses many pitfalls that often get in the way. Finally, he also discusses the greatest danger to quantifying risk... the black box highly sophisticated super model. The black box model disrupts more than it helps. Business owners are challenged to have confidence and work to manage a model that lacks simple transparency. Sim Segal devotes a great deal to this concept and illustrates a methodology that provides simple transparency to risk modeling. However, the author also takes the bold step to suggest that all risk within an enterprise can be calculated down to one single metric. This may be true, but this theory itself lacks a degree of practicality. Leaders still need a risk appetite statement and a small group of multiple measures that show the impact of their risk taking on the enterprise. Pure cash flow may not be the only measure of organizational performance for risk taking. I highly recommend this book for any ERM practitioner or executive looking to understand that the future of ERM is not just the management of downside risk. Instead, it is also the optimization of risk taking within the enterprise for the greatest performance.

| ASIN | 0470882549 |

| Customer reviews | 4.6 4.6 out of 5 stars (40) |

| Dimensions | 16.26 x 3.81 x 22.35 cm |

| Edition | 1st |

| ISBN-10 | 9780470882542 |

| ISBN-13 | 978-0470882542 |

| Item weight | 1.14 Kilograms |

| Language | English |

| Print length | 432 pages |

| Publication date | 5 April 2011 |

| Publisher | Wiley |

P**R

good

J**S

ERM practitioners have been striving for quite some time to build programs that measure risk in a quantitative manner, and that compares that risk back to management's appetite for risk taking. Sim Segal's book provides a practical methodology for a value based ERM program. Sim Segal does an excellent job in the opening chapters laying out the argument for value-based ERM in any enterprise, not just financial services firms. He also discusses many pitfalls that often get in the way. Finally, he also discusses the greatest danger to quantifying risk... the black box highly sophisticated super model. The black box model disrupts more than it helps. Business owners are challenged to have confidence and work to manage a model that lacks simple transparency. Sim Segal devotes a great deal to this concept and illustrates a methodology that provides simple transparency to risk modeling. However, the author also takes the bold step to suggest that all risk within an enterprise can be calculated down to one single metric. This may be true, but this theory itself lacks a degree of practicality. Leaders still need a risk appetite statement and a small group of multiple measures that show the impact of their risk taking on the enterprise. Pure cash flow may not be the only measure of organizational performance for risk taking. I highly recommend this book for any ERM practitioner or executive looking to understand that the future of ERM is not just the management of downside risk. Instead, it is also the optimization of risk taking within the enterprise for the greatest performance.

M**K

Okaish book...

B**A

Es un libro que debemos tener todos los que gestionamos riesgos en las empresas. Ofrece una cobertura amplia sobre la relevancia de la gestión de riesgos en el mundo empresarial y cómo abordarlo de una forma integral

C**O

I could not agree more with Dave Ingram, when he says, in the foreword of "The Corporate Value of Enterprise Risk Manager", that this could be the only ERM book you will ever need. The book offers an integrated road map for risk management, written in a very comprehensive way, and I believe that every risk practitioners (beginner or experienced risk executive) will find some interesting and "fresh" material. The book is also wide ranged, meaning that if you want theoretical concepts, you will find them, but it is also a very good "implementation guide". Finally, I will stress that this is not only a book on ERM, but mainly on the corporate value of it. The book of Sim Segal is highly recommendable.

Trustpilot

1 week ago

3 weeks ago